On July 3, Eric Chiou, Senior Research Vice President at TrendForce, was invited to speak at the Display Innovation China Forum 2024 (the 2024 DIC FORUM) in Shanghai. Chiou delivered a speech titled “The Rise, Development, Transformation, and Integration of Four Major Display Technologies,” and the content is as follows.

Image credit: DIC

Over the past year, the spotlight in the tech industry has almost entirely focused on AI. However, a closer look at the development in the display industry reveals a similarly impressive progress in technological development and diverse applications.

TrendForce analyzed the development of four major display technologies by focusing on their rise, development, transformation, and integration, delving into the future of the display industry.

“Rise” signifies the takeoff phase, particularly highlighting the emergence of head-mount devices (HMDs) and stimulating the demand for near-eye displays (NEDs).

TrendForce currently classifies HMDs into two main categories. Specifically, VR/MR devices prioritize immersive experiences, with their use transitioning from entertainment to productivity tools.

AR devices, which emphasize transparency and transmittance, mainly serve auxiliary functions. With the increasing diversity of metaverse applications and the refinement of AI functionalities, the overall shipments of XR headsets are projected to reach 60 million units by 2030, concurrently fostering demand growth for NEDs.

Among various NED technologies, OLEDoS has gained significant market attention, especially following its adoption in Apple Vision Pro. In addition to active strategies taken by Japanese and South Korean manufacturers, Chinese companies like SeeYA and BOE are also deeply investing in this technology. So far, a resolution of nearly 3,000 PPI has become the entry-level standard, significantly enhancing the user experience in XR devices.

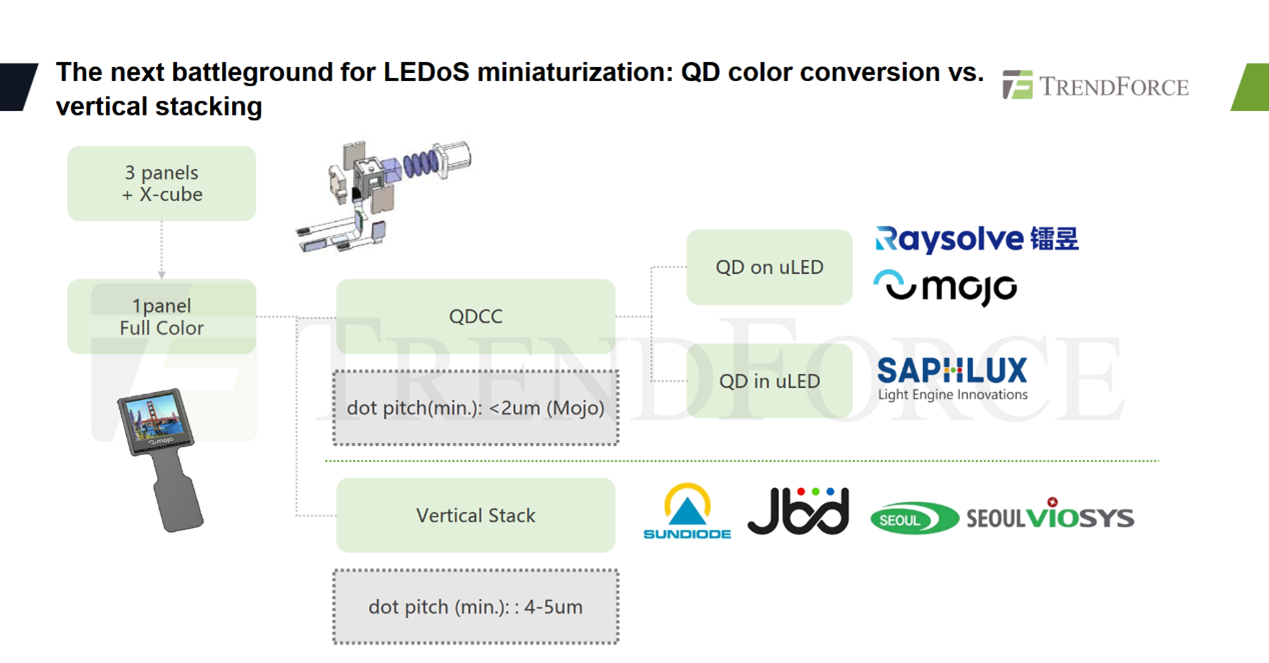

The key development for LEDoS lies in achieving full-color display capabilities. The market generally favors two technologies to this end: one involves quantum dot color conversion (QDCC), with main contributors including Saphlux and Mojo, while the other employs a vertical chip stacking structure, represented by JBD and Sundiode. Once full-color technology makes breakthroughs, LEDoS will greatly gain a competitive advantage in the NED field.

For the general public, it might be difficult to associate the mature LCD technology with emerging NED applications. However, due to its complex system, LCD still offers considerable room for specification enhancements through component optimization, which can meet the requirements of NEDs.

For example, improvements in liquid crystal materials can shorten response time, thereby reducing discomfort such as dizziness. Upgrades in backplane technologies like LTPO can effectively push the PPI limits. Even the backlighting system, which has been seen as somewhat cumbersome for LCDs compared to other display technologies, can significantly improve light utilization efficiency with the integration of laser light sources. Chinese tech giant BOE has invested considerable resources in LCD for NED applications, leading the way in pioneering new uses for LCD technology in the HMD market.

In the realm of VR/MR devices, the mainstream market is currently dominated by LCD technology thanks to its optimal cost-effectiveness. As OLEDoS supply increases and costs decrease, this technology is poised to gain a significant competitive advantage in the premium VR/MR devices.

In the AR sector, a variety of NED technologies such as LBS and LCoS are competing for dominance. OLEDoS, paired with the BirdBath optical structure, is the current market leader and is one of the few display technologies that span both the VR/MR and AR fields.

LEDoS, boasting small size and high brightness, aligns well with AR product requirements and shows great potential for future development.

"Development" signifies the second stage, indicating that the focus of medium to large-sized OLED applications will gradually shift from TVs to monitors.

OLED technology in the TV market has stagnated in recent years, with a penetration rate hovering around 3-4%.

Several factors have caused the stagnation, including limited supply making it difficult for OLED panels to compete with LCDs. Additionally, brands including Sony have shifted their preference from OLED to Mini LED backlighting, leading to unstable demand. The focus on the Gen 8.5 production also limits the flexibility of OLED to cater to different TV sizes.

Contrary to its poor development in the TV market, OLED technology has become indispensable for high-end monitors in recent years.

According to TrendForce, global shipments of OLED monitors were only 500,000 units in 2023, but are expected to surge to over 1.4 million units in 2024. Brands targeting the consumer market, such as Samsung, LGE, and Asus, are actively investing in OLED monitors, and even Dell, which is focused on the business market, is joining the fray.

Given the lack of competing technologies in the high-end market, OLED monitor shipments are expected to continue growing in the long term, reaching nearly 5 million units by 2027.

Could OLED laptops replicate the growth of monitors? TrendForce believes this will depend on two key indicators.

First, Apple’s adoption of OLED remains crucial for driving brand transitions and stimulating end-market demand. Although the OLED-powered iPads were introduced earlier this year, the larger MacBooks will not come with OLED until the completion of the Gen 8 OLED production line, expected in the latter half of 2026.

Second, there are still technological maturity issues that OLED must overcome for wide use in laptops. Significant technical advancements are being made in areas such as tandem structures, oxide backplanes, FMM-less evaporation, and blue phosphorescent materials. The maturity of these technologies will provide OLED with the necessary conditions to penetrate the laptop market more thoroughly.

Currently, Samsung and other brands with comprehensive resources are leading the way in strategic development for OLED laptops, while market leaders HP and Lenovo are still in the initial stages of their OLED plans.

Once these brands lead the market and technological breakthroughs are achieved, TrendForce predicts that shipments of OLED laptops will soar starting in 2026, surpassing 10 million units by 2027.

"Transformation" signifies change, depicting the evolution of LCD TV production from being undervalued to potentially becoming highly prized in the future.

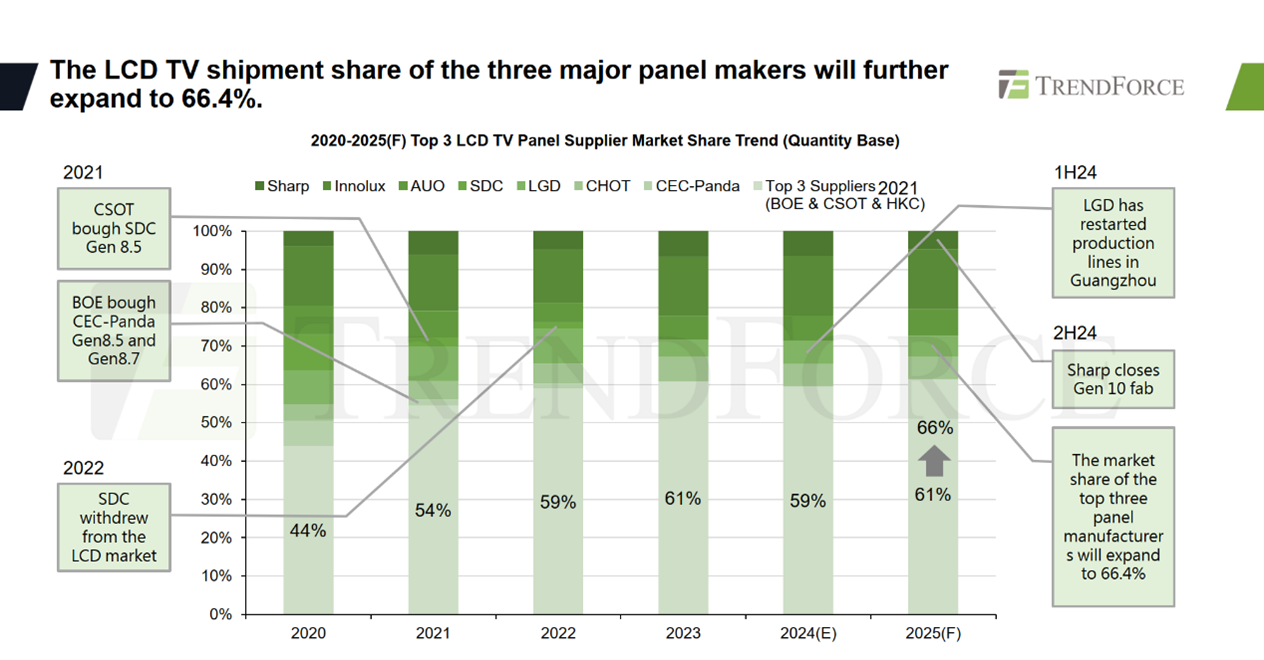

In 2020, BOE, TCL, and HKC—the world’s top three panel manufacturers—collectively held a market share of only 44%. In the following years, with competitors shutting down and continuous M&A in the industry, their combined market share is estimated to surge to 66% by 2025.

This concentration in the seller’s market indicates increased bargaining power and a greater influence over the entire supply chain.

Not only is the supply concentration increasing in the LCD TV industry, but the demand for ultra-large screens is also steadily rising. Products over 75 inches have become the new market favorite and an essential tool for brands to expand their market shares.

For instance, the demand for 85- and 86-inch displays skyrocketed from 2.8 million units in 2022 to 6.2 million units this year. Similarly, the demand for 98- and 100-inch displays is expected to double from last year. This trend of increasing screen sizes shows no signs of slowing down, including key products from Chinese brands TCL and Hisense that are expanding their influence in the end-user market.

Overall, following Sharp’s shutdown of its Gen 10 production line in Sakai, Japan, the total production capacity for LCD TVs is expected to decrease by 2% by 2025 compared to this year, equaling approx. 70,000 Gen 8.5 large panels per month. Although the demand for such panels has fallen following the decrease in production capacity, the demand for LCD TVs by area is still likely to grow in 2025 due to the booming development of large-size screens.

Under this trend, LCD TV production capacity is poised to become a critical resource for panel manufacturers to expand market influence and ensure stable profitability.

"Integration" captures the essence of synergy, indicating that competition between MiP and COB technologies will drive growth and expand the LED display market.

The fine-pitch LED display market comprises a variety of technologies. MiP’s advantage lies in its ability for simultaneous sorting and light mixing, significantly improving uniformity. In contrast, COB, which involves mounting flip-chip LEDs onto PCBs or TFT backplanes, excels in enhancing contrast, eliminating moiré patterns, and achieving HDR more easily.

In 2022, COB production capacity was around 21,400 square meters per month. With continuous expansion in the industry, the number is expected to reach 58,600 square meters per month by the end of 2024. Economies of scale will make products more cost-competitive. The 0404 MiP structure paired with BT boards can be produced using tape-and-reel and conventional SMT equipment, which lowers the barrier to product upgrades for manufacturers without requiring additional capital expenditures.

With these two technologies intersecting, TrendForce projects that LED displays will transition from business use to rapid expansion in home theater and virtual production applications.

According to TrendForce’s estimates, the total value of the LED display market will reach $8.3 billion in 2024 and grow to $10.7 billion by 2027, achieving a compound annual growth rate (CAGR) of 9%. In comparison, the market value of fine-pitch LED displays with a pixel pitch of 2.5mm (P2.5) or below will reach $5.2 billion in 2024 and jump to $7.4 billion by 2027, with a CAGR of 12%, outpacing the overall market growth. Concerning ultra-fine pitch displays with a pixel pitch of 1.0mm (P1.0) or below, driven by both MiP and COB technologies, the market value will surge from $370 million this year to $1.15 billion by 2027, boasting an impressive CAGR of 34%.

The rise of XR devices driving the demand for NEDs, the shift of OLED from the medium-to-large TV market to the monitor market, the strategic repositioning of LCD TV production capacity, and the integration of MiP and COB technologies expanding the LED display market will all create more business opportunities and value within the display industry.

TrendForce 2024 Near-Eye Display Market Trend and Technology Analysis

Release Date:2024 / 07 / 31

Languages:Traditional Chinese / English

Format:PDF

Page:164

TrendForce 2025 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 30 September 2024

Language: Traditional Chinese / English

Format: PDF

Page: 302

|

If you would like to know more details , please contact:

|